This is installment 2 of Decoding Grid Economics

Utility Tariffs: The Retail Bridge to the Consumer

While nodal prices govern the wholesale market, Utility Tariffs are the rates that end-use customers—residential, commercial, and industrial—actually pay for their electricity. Often referend to as simply your “plan”, these tariffs are designed to recover the utility’s costs of doing business, which include:

- Wholesale Electricity Costs: This is the most significant component, reflecting the price the utility pays for electricity in the wholesale market (which, in turn, is heavily influenced by nodal prices).

- Transmission and Distribution (T&D) Costs: The cost of building, maintaining, and operating the physical infrastructure that delivers electricity from power plants to homes and businesses.

- Administrative and Operational Costs: Expenses related to billing, customer service, and other utility operations.

- Taxes and Regulatory Fees: Government-imposed charges that support various energy programs and regulatory oversight.

How do utility tariffs connect to grid economics?

Utility tariffs are the rates and rules set by the local utility company that determine how a customer is charged for electricity. They can be structured in various ways, including:

- Flat rates: A single price per kilowatt-hour (kWh) regardless of time or usage.

- Time-of-use (TOU) rates: Prices vary based on the time of day, encouraging consumers to shift usage away from peak demand periods.

- Demand charges: Based on the highest level of power consumption during a billing cycle, often applied to commercial and industrial customers.

Utility tariffs determine the final price a consumer or business will pay, incorporating not just the cost of electricity coming from the grid but also costs related to distribution, customer service, and other factors.

- Price Signal Translation: While retail tariffs often aim for stability and predictability, they are fundamentally influenced by the underlying wholesale market dynamics. Changes in wholesale electricity prices due to factors like fuel costs, supply-demand imbalances, or transmission constraints will eventually trickle down to retail tariffs, although often with a delay due to regulatory review processes.

- Incentivizing Behavior (or not): Traditional flat-rate tariffs may not fully pass on the real-time price signals from the wholesale market. However, increasingly, utilities are implementing more dynamic tariffs, such as Time-of-Use (TOU) rates, Critical Peak Pricing (CPP), or even real-time pricing for large industrial customers. These tariffs aim to encourage consumers to shift their electricity consumption away from peak demand periods, thereby reducing strain on the grid and potentially lowering their bills.

- Policy and Investment Impacts: Regulatory decisions regarding tariff structures can significantly impact grid economics. For example, tariffs that incentivize energy efficiency, renewable energy adoption, or the deployment of distributed energy resources (like rooftop solar and battery storage) can alter demand patterns and influence the need for new generation and transmission. don’t adequately recover

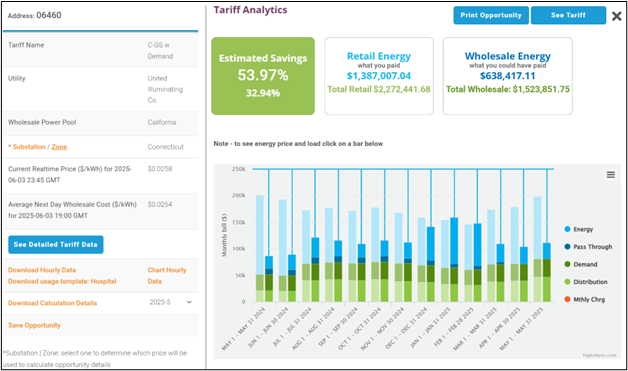

Clarity Grid provides powerful tariff analysis and insight by generating a synthetic bill for side-by-side scenario comparison. The simplest form is a comparison of wholesale rates based on your usage vs. the regulated utility billing rate. The model also allows users to compare two different tariff rates at the same Utility to identify the most cost effective plan or simulate the savings benefit that a behind-the-meter strategy such as adding solar or battery storage will provide. With the introduction of FERC Order 2222, DER operators are also engaging with the energy market, and Clarity’s model provides a unique tool for calculating the combined benefits of both participating in the “Front of the Meter” wholesale market price tariff with “Behind-the-Meter” storage solutions.

(This is Part 2 of 4 Blog Posts for “Decoding Grid Economics”. Read part 3 here.)