Executive Summary

The primary emphasis in previous updates centered on generation additions, reflecting the US Power Industry’s priorities. However, projections of substantial load growth from data center development, driven by AI demand, have now become the dominant concern due to their grid impact as large loads. While load-serving capacity additions have always been monitored, data center construction is now highlighted as its own distinct category within Load.

The Importance of Granular Grid Data

The US electric grid, like others globally, is best understood through granular data at the price node (Pnode) level. The fixed transmission network is the sole means of transporting electricity, necessitating centralized management under strict security and safety protocols. This requires market participants to comprehend the operation and evolution of each grid component under varying conditions. The significant focus on grid delivery for applications like EVs, AI-driven cloud computing, and wholesale distribution has generated considerable interest among stakeholders in the present and future state of grid infrastructure and operations.

Q1 2025 Data Center and Grid Growth

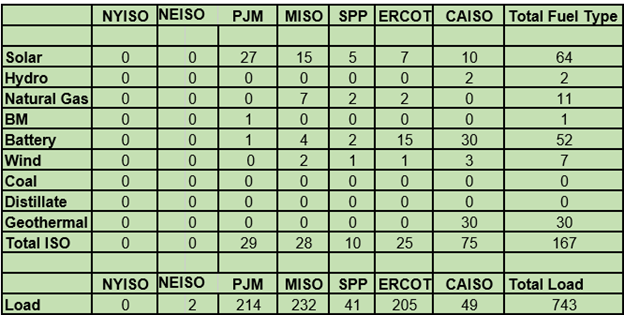

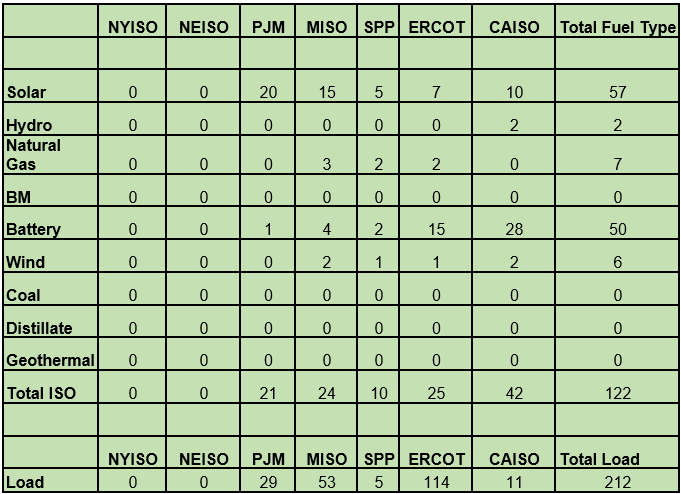

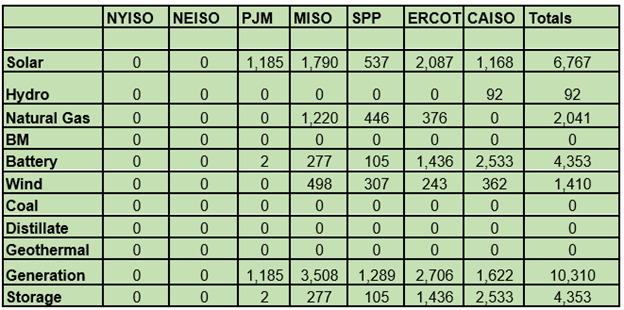

Overall, the number of ISO Price Nodes (PNodes) across the seven US ISOs increased by 910 in Q1 2024, with 743 attributed to Load and 167 to Generation. This brought the total PNode count in Clarity’s database to 83,109. Accounting for PNodes associated with existing infrastructure, net load node additions were 212, while generation and storage additions totaled 122. In terms of capacity, grid additions included 10,039 MW of Generation and 4,352 MW of Storage. Solar additions were the most significant, representing almost all generation additions at 6,767 MW, followed by strong battery storage additions of 4,352 MW, with CAISO and ERCOT once again dominating all other ISOs. Twelve new data center projects were identified in PJM, CAISO, and MISO territories.

Clarity’s Approach to Grid Tracking

Clarity has devoted years and large amounts of resources aggregating, tracking, and updating our catalogue of data covering the US Electric Grid, using data provided by the US ISOs combined with a vast array of public sources to create this bottom-up view. This has allowed us to navigate through the noise of proclamations of “revised queue” initiatives, and developer announcements of new projects, to identify underlying trends on a regional and national level. For example, for several quarters we have been flagging the rapid decline in Wind generation nationwide, and the lack of significant additions of resources in NEISO, NYISO and PJM. This has contrasted sharply with the rapid additions of Storage resources in CAISO and ERCOT and almost nowhere else. In centrally dispatched power pools–ISOs–any entity charged with either generating/storing or delivering power must be assigned a Pnode tied to a physical facility which is awarded a price for settlement, or Locational Marginal Price (LMP). Following our strict discipline of tracking only PNodes awarded by the Central Authorities, ISOs, and then matching these with all the other data necessary for context, such aslocation, size, utility, and transmission line capacitiesallows for such insight. This method also allows for minimal lag in reporting the movement from Queue to Operations.

Review of 1st Quarter PNode and Capacity Additions by ISO

In aggregate 910 new PNodes were added over the Quarter, 743 for Load and 167 for Generation. MISO, PJM, and ERCOT all registered over 200 new PNodes for Load while CAISO let in new Generation PNodes with 75, and ERCOT, PJM and MISO registered over twenty, see Chart 1.

The distinction between newly added and truly new additions can be seen by comparing the 2 Charts below.

Chart 1

1Q 2025 Notional Node Additions

Chart 2

1Q 2025 Newly Constructed Node Additions

As can be seen from a comparison of the 2 Charts, with the exception of CAISO dropping Generation Nodes due to additional capacity to existing facilities, Generation Nodes remained essentially unchanged. With the exception of a significant number of new Load PNodes being added in ERCOT due primarily to new Battery facilities, truly new Load PNodes dropped dramatically in all other regions. Most of the remaining truly new Load PNode count was assigned to new Data Centers, discussed further below.

Newly Constructed Generation (Storage) by Fuel Type

ISO reporting procedures allow matching of the PNode data to aggregate megawatts of newly constructed generation, unlike new additions of Load serving PNodes where capacity additions are not as clear cut. In looking at Generation additions over the Quarter we can see that 10,309 mws of Generation, and 4,353 mw (not mwhrs) was added to the ISO Grid (Chart 3)

Chart 3

4Q 2024 Newly Constructed Node Additions (mw)

Solar once again dominated the category of new generation, adding 6.797 mws during the Quarter with ERCOT, MISO, CAISO, and PJM each registering over 1 Gw of additions. In keeping with the comeback story for natural gas, MISO stood out with 2 projects contributing over 1.2 Gws of aggregate capacity in Entergy La and Tx. Both ERCOT and SPPP also registered significant new additions of natural gas fired capacity with two new plants in SPP and one in ERCOT. Both CAISO and ERCOT continued to dominate additions of Battery (Storage) capacity, with only token additions in MISO and SPP. CAISO additions are even more noteworthy when considering that most CAISO additions are 4-hour mwhr durations designed to qualify for Resource Adequacy (RA) payments. RA market values have remained strong over the past year, reflecting the dominance of Solar additions in the ISO and the consequent need for dispatchable capacity. Other notable additions were due to new Natural Gas plants in MISO, SPP, and ERCOT, as well as relatively small additions of Wind projects in MISO, SPP, CAISO, and ERCOT.

Noteworthy Examples of Generation Additions:

ERCOT

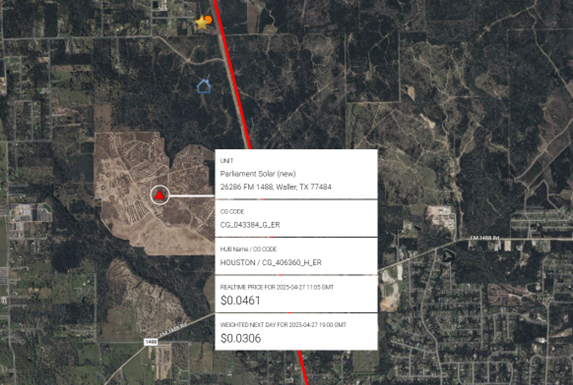

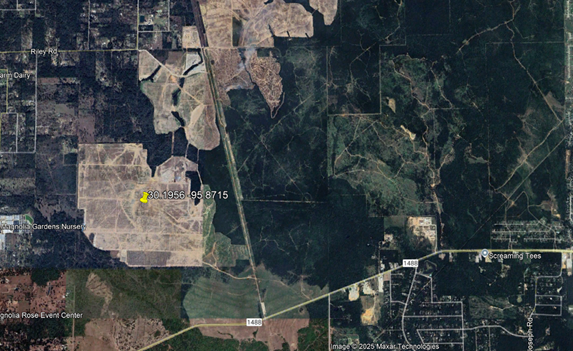

Just 6 projects contributed to the 2,087 mws of Solar addition to the ERCOT Grid during the Quarter, the largest of them all is the 640 mw Parliament Solar –backed by Encap and developed by Mercuria—which is due to come online in Waller TX (see below):

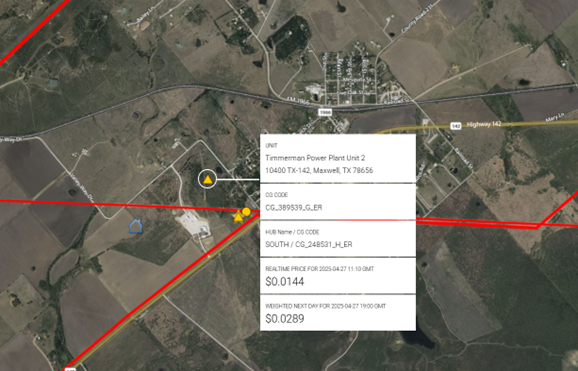

Timmerman Power Peaking Units 1 and 2 came online in LCRA’s Maxwell, TX South Zone territory. Both Units sets of 10 Wartsila reciprocating engines are rated at 188 mw of capacity and LCRA is also listed as the Owner.

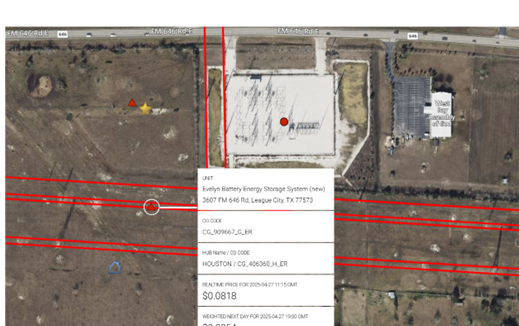

For Storage, ERCOT added 17 new projects with mw ratings ranging from 8 projects of the traditional 9.9 mw size to the large 452 mw Evelyn Battery Storage developed by Balanced Rock Power and recently acquired by Goldman-backed Gridstor;see Evelyn below in League City, TX and adjacent to the existing Hidden Lakes 138 kv Substation owned by TNMP.

CAISO

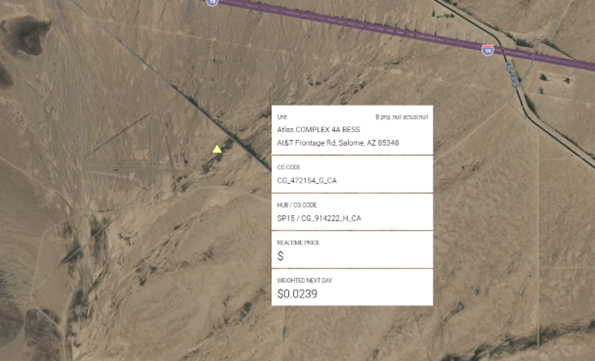

Sixteen different Battery projects added 2.533 mws to the CAISO Grid over the Quarter with additions ranging from 1.2 mw (Foster Clean Power B) to the sprawling 922 mw Atlas Complex development matched to 6 individual PNodes; see Atlas Below:

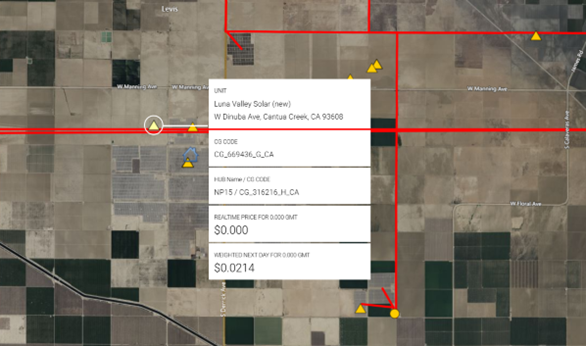

For Solar, 10 projects contributed to the 1,168-mw capacity addition over the Quarter with the largest being Luna Valley 1-3 just north of the existing 205 mw Tranquility Solar Project in Cantua Creek, CA in PG&E Northern CA territory, see below:

Mexico

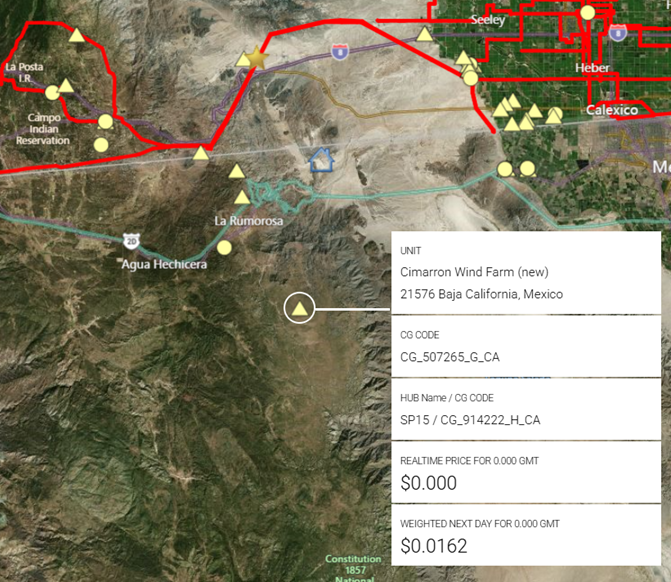

Lastly, while Wind development has slowed considerably over the last several quarters and the current Administration has put the industry out of favor, Mexico has seen successful development by Sempra Infrastructure of the 320 mw Cimarron Wind Farm in the Mexican Baja area, see below:

MISO

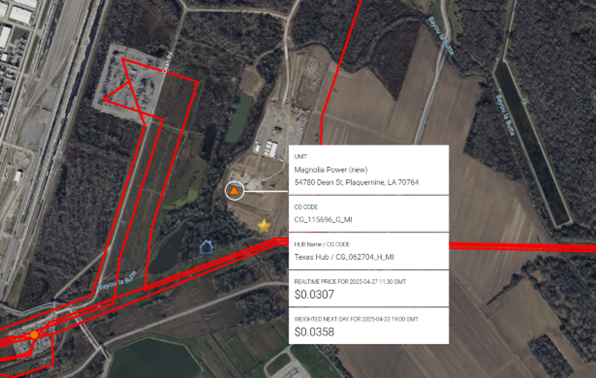

Two new natural gas projects contributed to 1,220 mw of new capacity in MISO, this included additions to the coal to natural gas converted A B Brown Unit in Southern Indiana Gas and Electric (SIGE) territory with 2 units contributing 248 mws each and the new Magnolia Power plant in Louisiana Industrial Corridor territory at Plaquemine, LA developed by Kindle Energy and registering 722 mws. Screenshots for both projects are shown below:

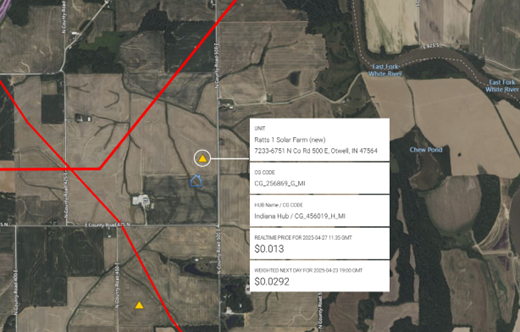

While MISO added 1,790 mws of Solar over the quarter, additions were well distributed with 15 different projects ranging from 42 to 300 megawatts constituting the total. Also noteworthy were 3 projects, in Indiana with Meta listed as Owner, Ratts 1 Solar Farm in Otwell, IN is one of the Meta projects (shown below):

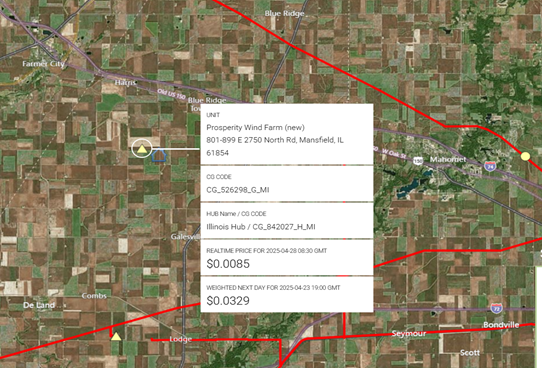

Rounding out MISO Generation additions and demonstrating that Wind development continues is Apex Clean Energy’s 300 mw Prosperity Wind Farm, in Ameren territory of Mansfield, IL.

PJM

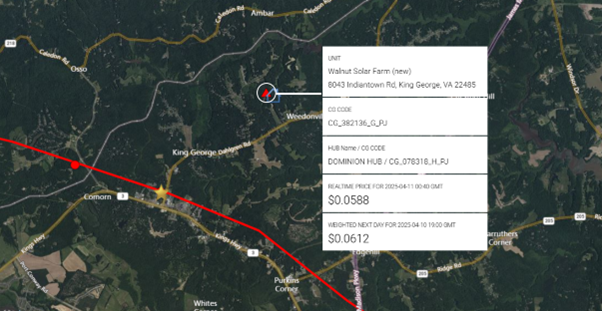

With the exclusion of a very small Battery project, all Resource additions for PJM were Solar powered with 20 projects contributing to the 1,785-mw total. The largest of these new Solar projects, the 150 mw Walnut Solar Farm developed by Dominion Resources, is shown below:

SPP

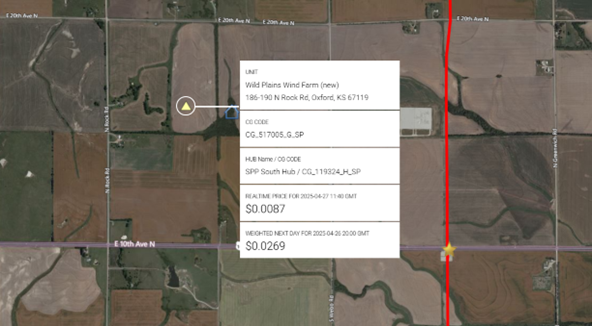

In contrast to PJM’s “Solar Only” approach, SPP added a variety of resources over the Quarter, including Solar, Natural Gas, Wind and Battery. The largest addition, NextEra Energy’s 307 mw Wild Plains Wind Farm in Oxford, KS which feeds into the Westar transmission network as shown below:

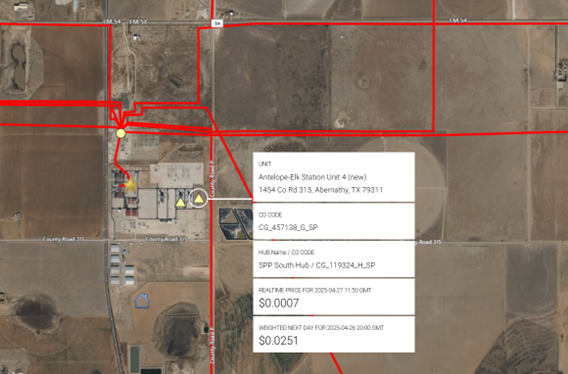

While it is always noteworthy when thermal generation is added to the Grid as it goes against the massive renewable development trend, additions to SPP were due not to new facilities, but additions to existing natural gas plants. The presence of existing infrastructure and in some cases, permitting, obviously facilitates these types of builds. The two existing plants representing new additions were: almost 200 mw of new gas-fired generation at the Antelope-Elk Station Unit 4 and the 245-mw addition at the Pioneer Generation Station Unit 5 by Golden Spread Cooperative and Basin Electric Cooperative respectively. The Antelope Elk facility is shown below:

Noteworthy Examples of Load Additions:

PJM

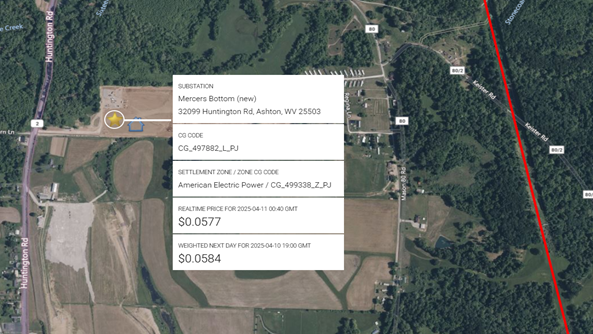

Mercer’s Bottom

Mercer’s bottom is a Appalachian Power (AEP) newly constructed 345 kv substation built to serve a new Nucor Steel plant in Ashston, WV.

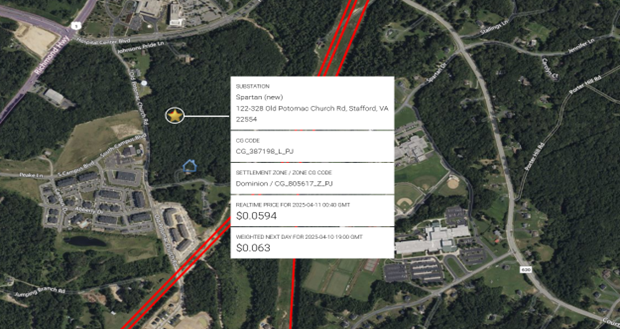

Spartan

Spartan is a newly constructed Dominion Virginia substation connected at 34.5 kv line capacity in Stafford, VA. The substation will serve general load growth in the Stafford, VA area.

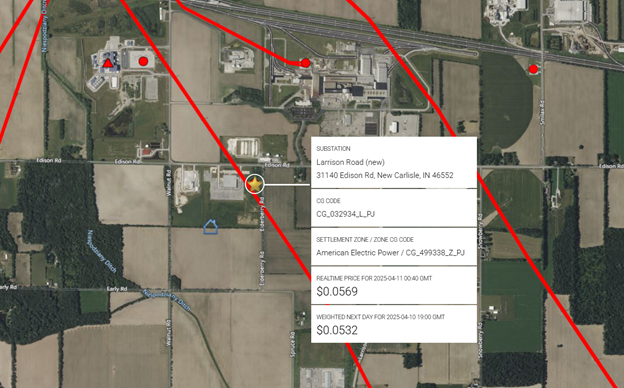

Larrison Road

Larrison Road is an Indiana Michigan (AEP) newly constructed substation to serve new Norfolk Southern Railroad load can connected at AEP 345 kv line capacity.

CAISO

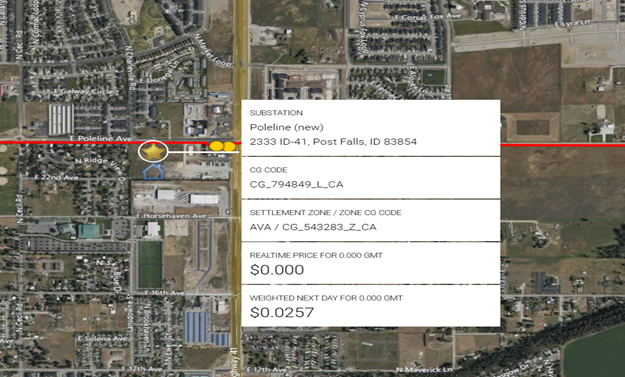

Poleline

Poleline is a Kootenai Electric Cooperative substation built to serve load growth in the Post Falls, ID territory and connected at 69 kv line capacity.

ERCOT

ERCOT’s most recent Load growth forecast projects peak usage to roughly double by 2030. Unlike some of the projections coming out of PJM, this is not due entirely to Data Center builds. ERCOT stands out as the region which is actively adding new substation capacity for both transmission as well as distribution increases in Load. As seen in the most recent Quarter 8 new substations were added outside of those dedicated specifically to Data Centers. Three of these are profiled below.

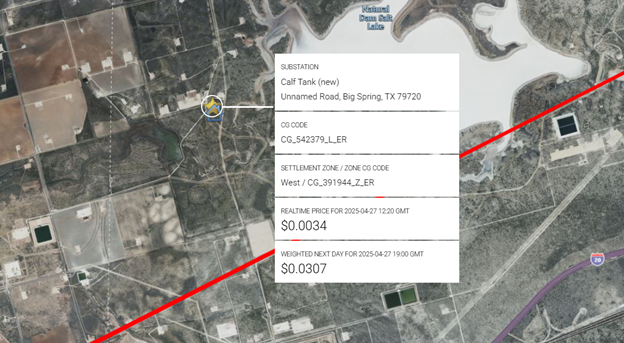

Calf Tank

Calf Tank is a new Oncor substation connected at 138kv and serving E&P load in the Big Spring (West Texas) area.

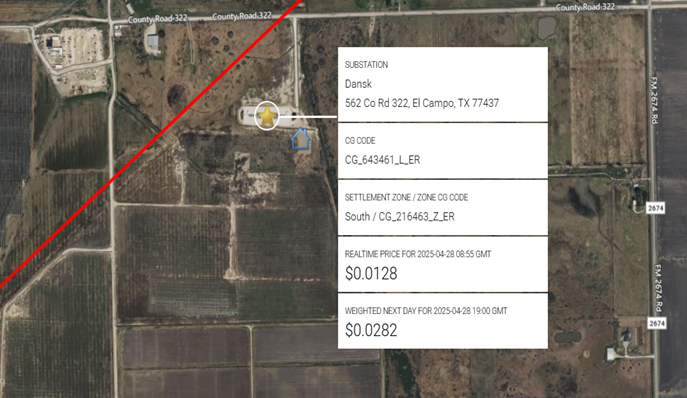

Dansk

Dansk is a new South Texas Electric Coop (STEC) substation connected at 138kv to the AEP Central Texas transmission system. There is no obvious load-serving customer at this location.

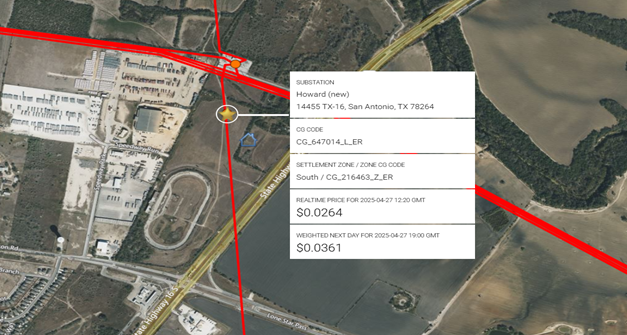

Howard

Howard is a new CPS Substation built just south of the existing Howard Road Substation and connected to Bandera’s 138/345kv system. The substation was built to serve overall load growth in the San Antonio area. The new Howard substation is visible in the Google Earth image.

SPP

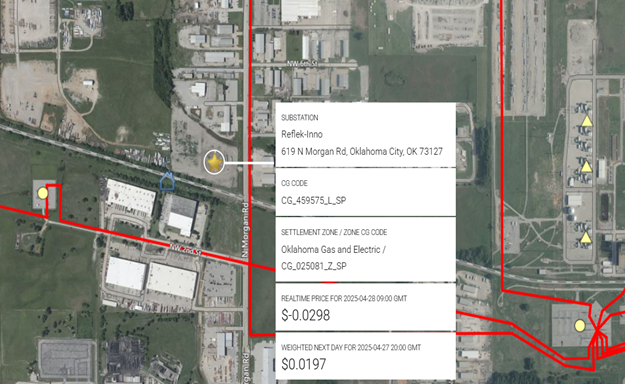

Reflek-Inno

Reflek is a new OKGE Substation added to serve new manufacturing plant in OK owned by Reflek Technologies and is connected to OKGE’s transmission system at 138kv voltage.

Data Center Additions

PJM

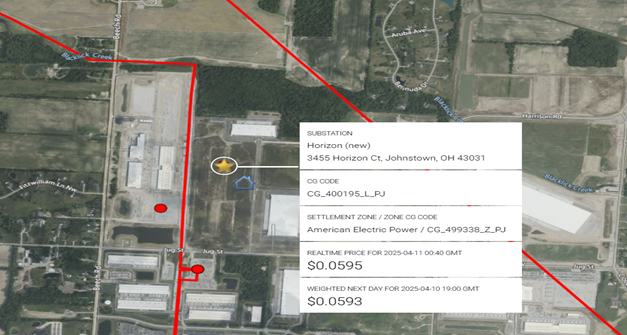

Horizon-Vantage Data Center

The new Horizon Substation was recently constructed at 138kv capacity but sits adjacent to AEP’s 345kv transmission line. This Substation first started reporting prices in April, 2025. The Vantage Data Center is listed at 1.5 million square feet powered at 192 mw of capacity. The facility is slated to be operational in December of this year.

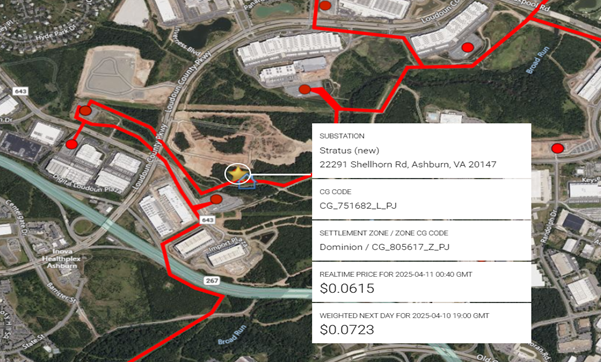

Stratus-QTS Ashburn Shellhorn Data Center

The Stratus substation was recently constructed at a PJM listed line capacity of 36kv and connected to Dominion Resources transmission at 230kv. The QTS Shellhorn facility is listed at 80 mw of critical campus deliverability. The PNode shows price activity beginning in April.

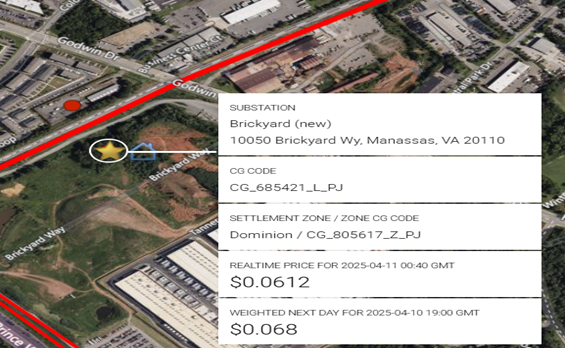

Brickyard-Digital Realty 9905 Godwin Data Center IAD53

The Brickyard substation is a NOVECC constructed substation connected at 230 kv to the Dominion Va transmission system. The Godwin Data Center is listed at 185,000 sq ft implying a power delivery capacity of 37-74 mw depending upon power density.

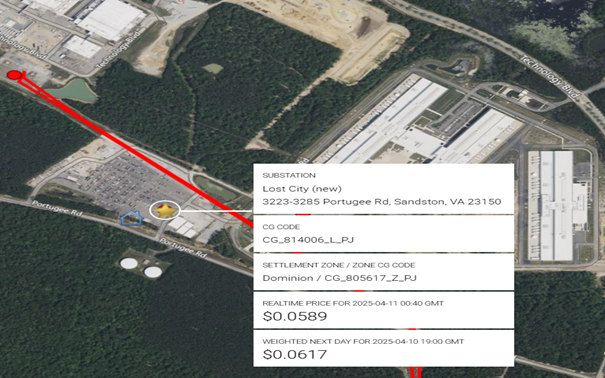

Lost City-QTS Richmond Data Center

The Lost City substation is owned by Dominion and is listed as connected at 36kv; it is adjacent to Dominion’s 230kv system. The substation serves the QTS Richmond Data Center a 240-mw load under construction, see both Clarity and Google Earth images below. The substation is located in the Richmond area, some 100 miles south of “Data Center Alley” near Manassas, VA.

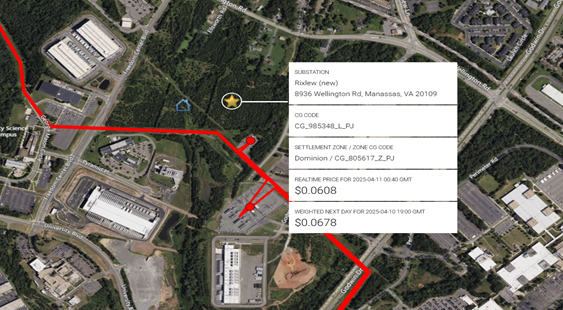

Rixlew-Stack Infrastructure NVA05A

Rixlew is a NOVECC 230 kv substation connected 230 kv Dominion Virginia transmission system built to serve the STACK Infrastructure NVA05A Data Center. STACK is listed at only 36 mw of capacity over 262,000 sq ft and powered completely by renewable energy.

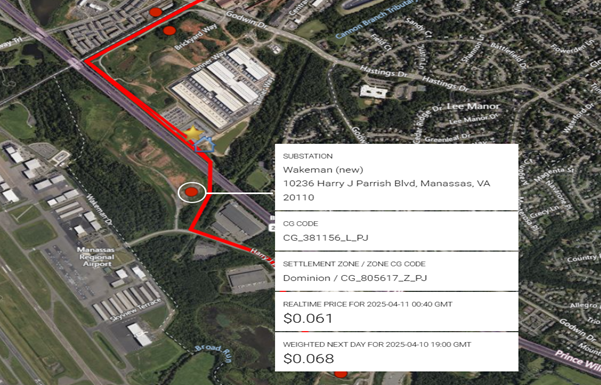

Wakeman-Digital Realty IAD50

Wakeman is a 36 kv line connected Dominion Va substation built to serve the new Digital Realty IAD50 Data Center. The facility is listed as only 4.8 mw of capacity and 802,135 sq ft. Depending upon power density, this would seem to imply a necessary power capacity of 160-320 mw, so this is either beginning co-located capacity with the Grid supplying the balance or the number is incorrect.

CAISO

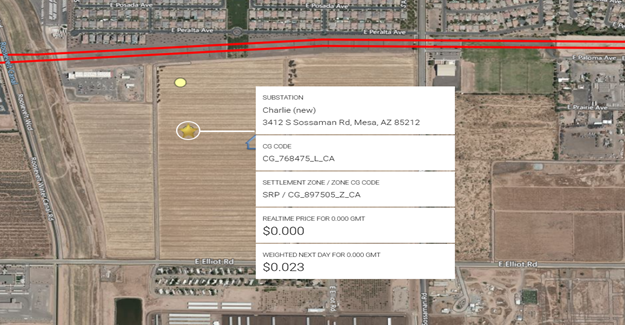

Charlie-Red Hawk Data Center (Google)

Charlie is a newly constructed SRP substation connected at 230kv line capacity in CAISO EIM SRP territory in Mesa, AZ. The substation is built to serve the Redhawk Data Center owned by Google and listed at 1.25 million sq ft, implying power delivery capacity of 250-500 mw depending upon power density.

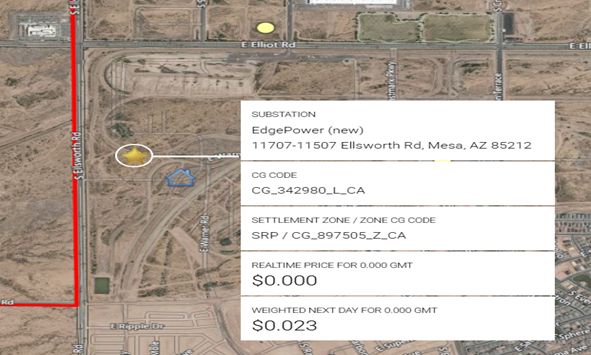

EdgePower-Meta Mesa Data Center

Similarly, EdgePower is a SRP 230 kv connected substation in Mesa, AZ built to serve the Meta Mesa Data Center. The square footage of the entire campus is slated at 2.5 mm sq ft which would imply 500-1,000 mw of power capacity. However, this campus is also served by the Konos substation listed below.

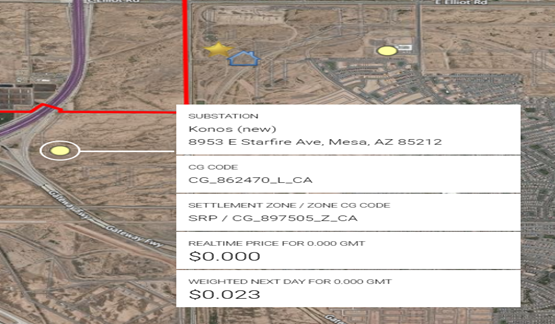

Konos-Meta Mesa Data Center

Konos is also a SRP-constructed substation connected at 230 kv line capacity in Mesa, AZ. The substation was also built to serve the Meta Mesa Data Center. It is not clear the stage of completion of the entire Meta Mesa Data Center at this time.

MISO

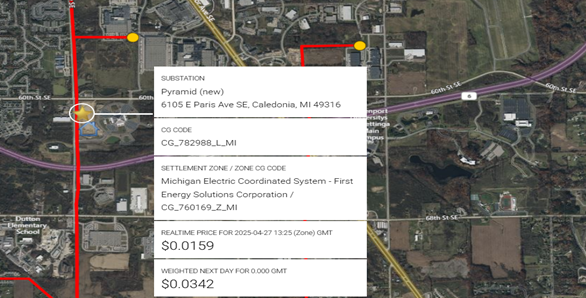

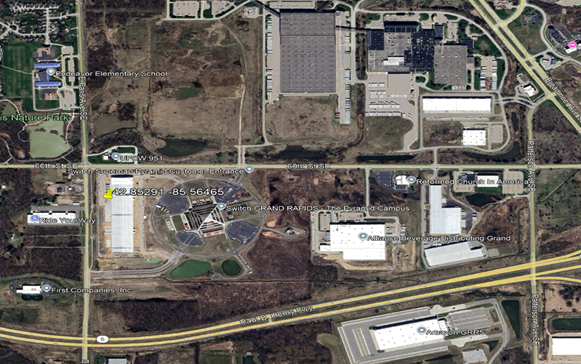

Pyramid-Switch Grand Rapids Data Center

Pyramid Switch is a Consumers Energy newly constructed substation connected at 138 kv line capacity on the Consumers Energy transmission network. The Substation was built to serve the new Switch Grand Rapids Data Center listed at 1.8 mm sq ft and 110 mw of power capacity. It is possible this is the initial or standby capacity for the facility as the square footage implies 360-720 mw of necessary capacity depending upon density.

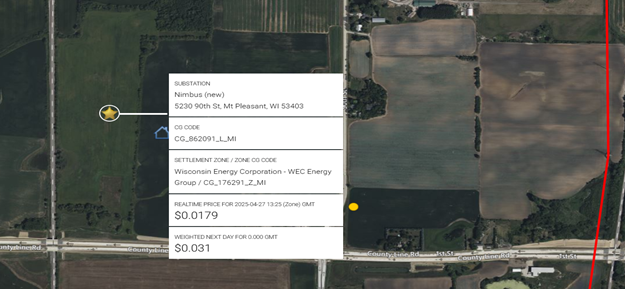

Nimbus-MSFT MKE Data Center

Nimbus is a Wisconsin Electric Power newly constructed substation listed as connected to Wisconsin Electric’s 138 kv although it is adjacent to a 345 kv line.

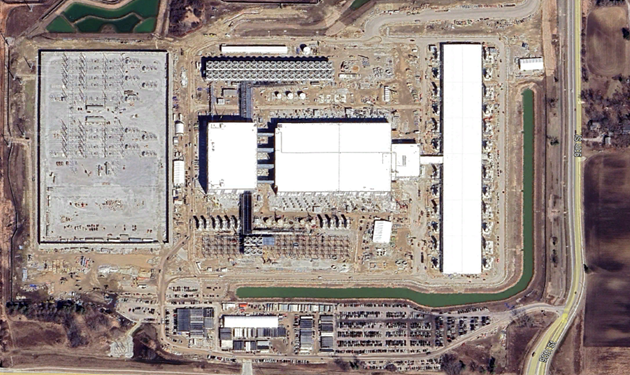

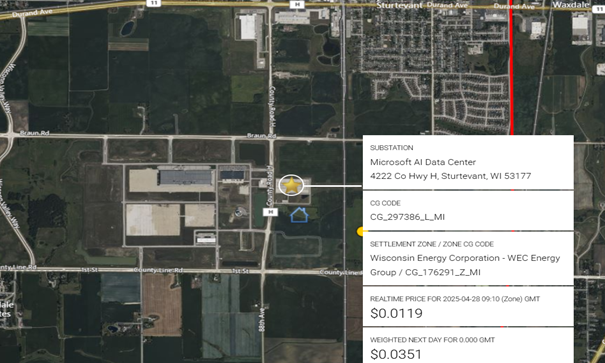

31Microsoft AI Data Center- Microsoft AI Data Center

The Microsoft AI Data Center substation was constructed by Wisconsin Energy and connected at 138 kv transmission. The facility is adjacent to the Nimbus substation listed above which is adjacent to a 345 kv transmission line. The only metrics published for the AI Data Center are listed covering 1,345 acres.

If you are interested in viewing all existing and new load and gen facilities, please inquire about a trial at https://www.claritygrid.net and select “Request a Demo.”