With the press reporting customers in Texas reeling from power bills, in some cases over $10,000, how bad did it get for the average customer in ERCOT on wholesale billing? How bad would it have been for customers in Texas outside of ERCOT had they contracted for power off wholesale prices? While SPP and MISO serve parts of Texas their pricing remains regulated at fixed prices. Still all three ISOs have market structures for wholesale generators and suppliers which are very similar which means that transactions are settled at these prices, and the cost for price spikes and volatile wholesale markets must ultimately be paid by those served by the Grid.

ERCOT

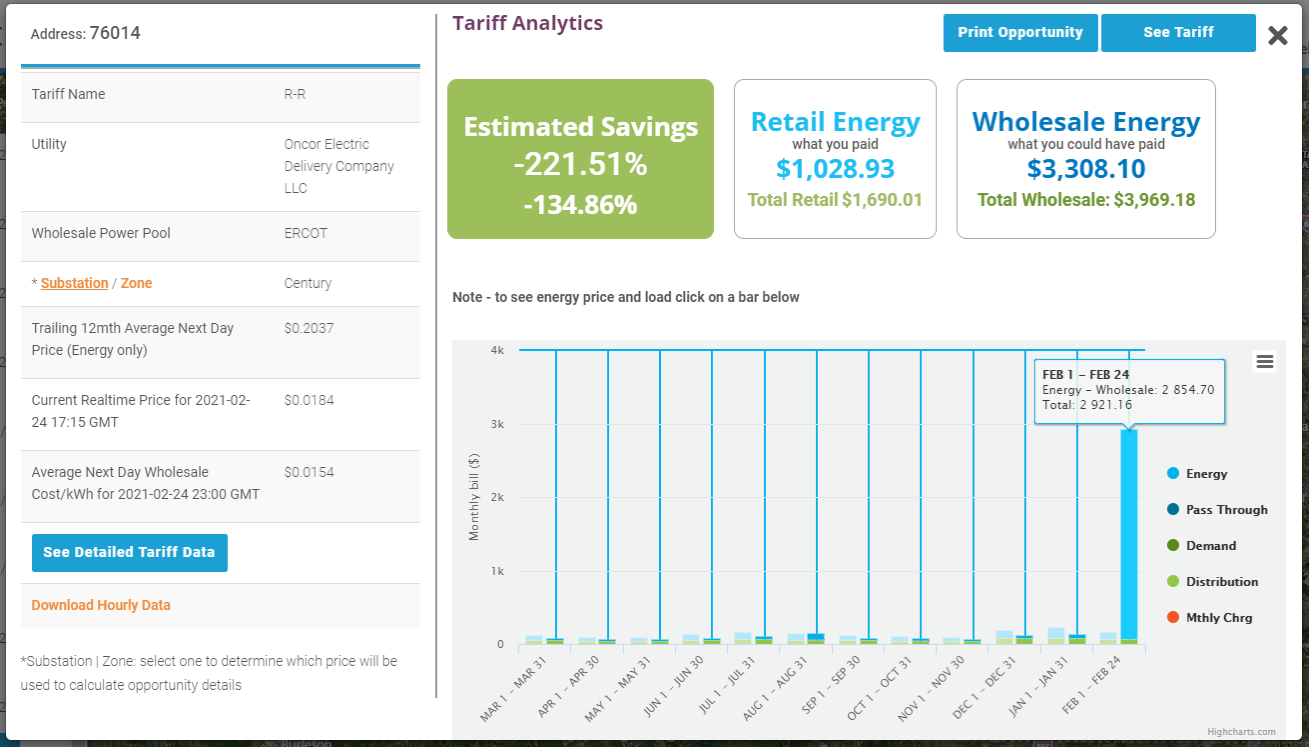

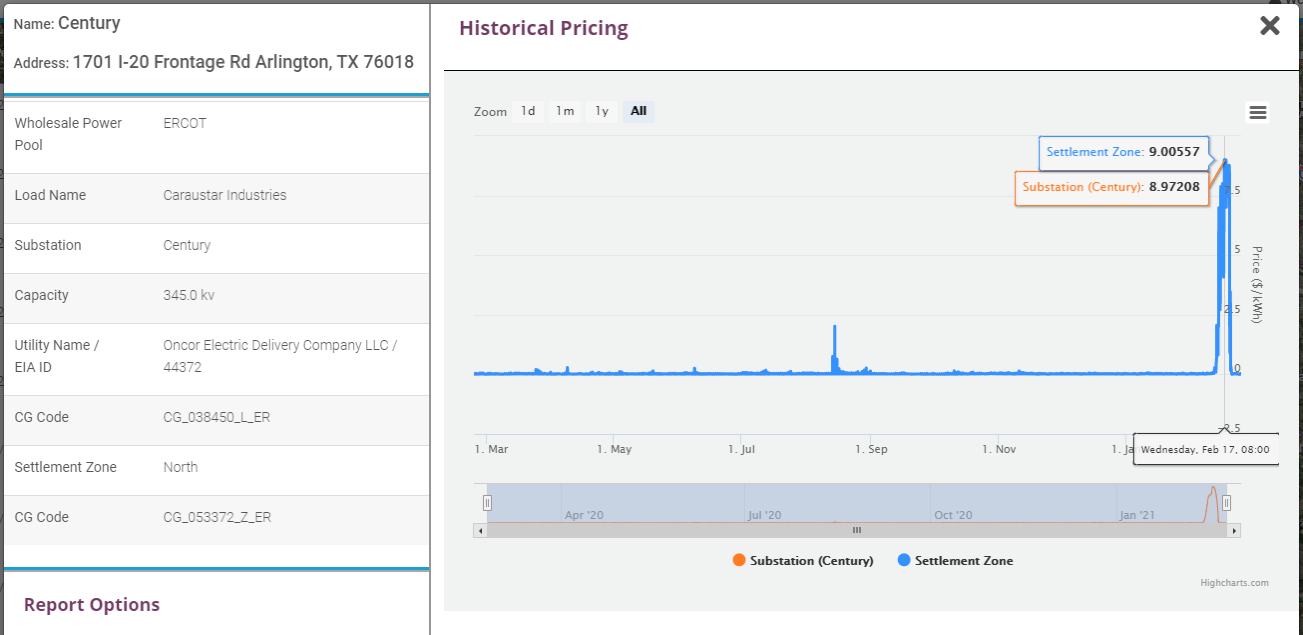

Dallas:

Most customers in the Dallas area are served by Oncor and are on a standard R-R rate for the regulated Distribution portion of their electric bill, this averages out to be about $.04 kwh. While the average fixed rate for Oncor customers is sometimes difficult to determine as it varies with duration and usage, Griddy (the REP most frequently cited for “price gouging” as their rates are tied to ERCOT wholesale price) uses a $.121 all in fixed rate as a comparison, or $.081 for Energy. Prior to the February freezes, an average residential consumer using between 800 and 1,500 kwhrs per month would have paid only about $75.00 per month for electricity, and only between $20-$30 for the “volatile” Energy portion of their bill. Clarity uses NREL based monthly and seasonal estimates for consumption by a representative Residential or Commercial building in the closest sample city. For the sake of the Analysis, we have not revised these estimates for colder weather during the price spikes, nor for lower consumption due to outages or reductions in consumption due to price. By contrast a customer on a fixed rate contract at average ERCOT rates would have paid about $130.00 per month with $81.00 of the bill being paid for Energy. Of course, this all changed in February as their average bill skyrocketed to just above $2,600 (Chart 1), with still a few days remaining. How did this happen? Chart 2 shows a history of wholesale prices for the last year (Next Day ERCOT North). From the period of Sunday 2/14 at 8:00 am until Friday 2/19 at 9:00 am prices gapped to $7.00 to $9.00 per kwh and stayed there with few hourly exceptions. For context prior to the period stretching back one year wholesale prices were usually in the $.015-$.025 range. Clearly any gains realized during the year were obliterated in mid-February holding aside power which was not paid for due to outages or conservation on the part of these consumers.

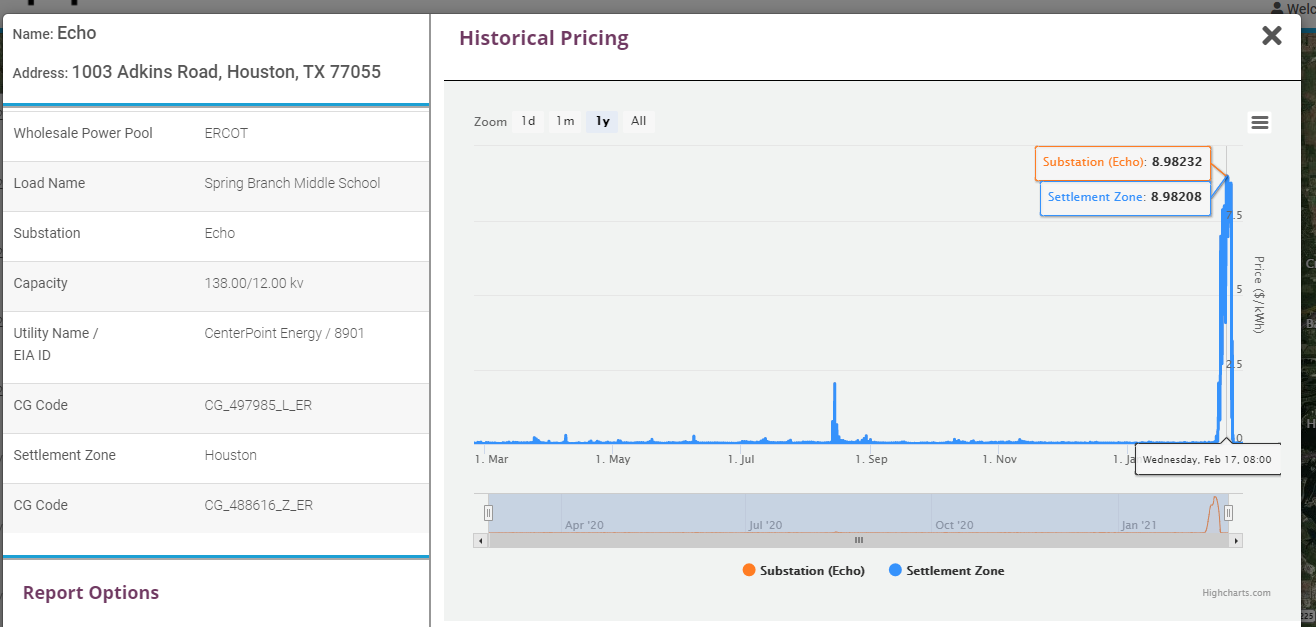

Houston:

The situation for Houston power customers was obviously similar to Dallas. Centerpoint is the Distribution Utility form most of Houston and most retail consumers are on the Utility’s R-Residential Rate which also averages out to $.04 for Distribution. Using the same “average” fixed rate of $.081 shows similar monthly savings for a customer on wholesale billing prior to mid-February, of $30-50 per month and average monthly bill of about $80 versus $130. Chart 3 shows the monthly comparison incorporating February where the average bill would have skyrocketed to over $2,400 for February with still a few days remaining. The lower bill for Houston customers is mostly due to lower estimated usage in an average February in Houston versus Dallas. Chart 4 shows wholesale price history for ERCOT Houston Zone Next Day pricing. Unsurprisingly, wholesale prices show a similar pattern to Dallas as the Sunday 2/14 7:00 am to Friday 2/19 9:00 am period saw prices mostly in the $7.00-$9.00 range. Again, any savings accumulated over the year from buying $.015-$.025 wholesale prior were obviously extinguished during this period. At a minimum however using this type of data based rigorous analysis does at least benchmark these extraordinary electric bills into a consistent 25 to 30x range of increases.

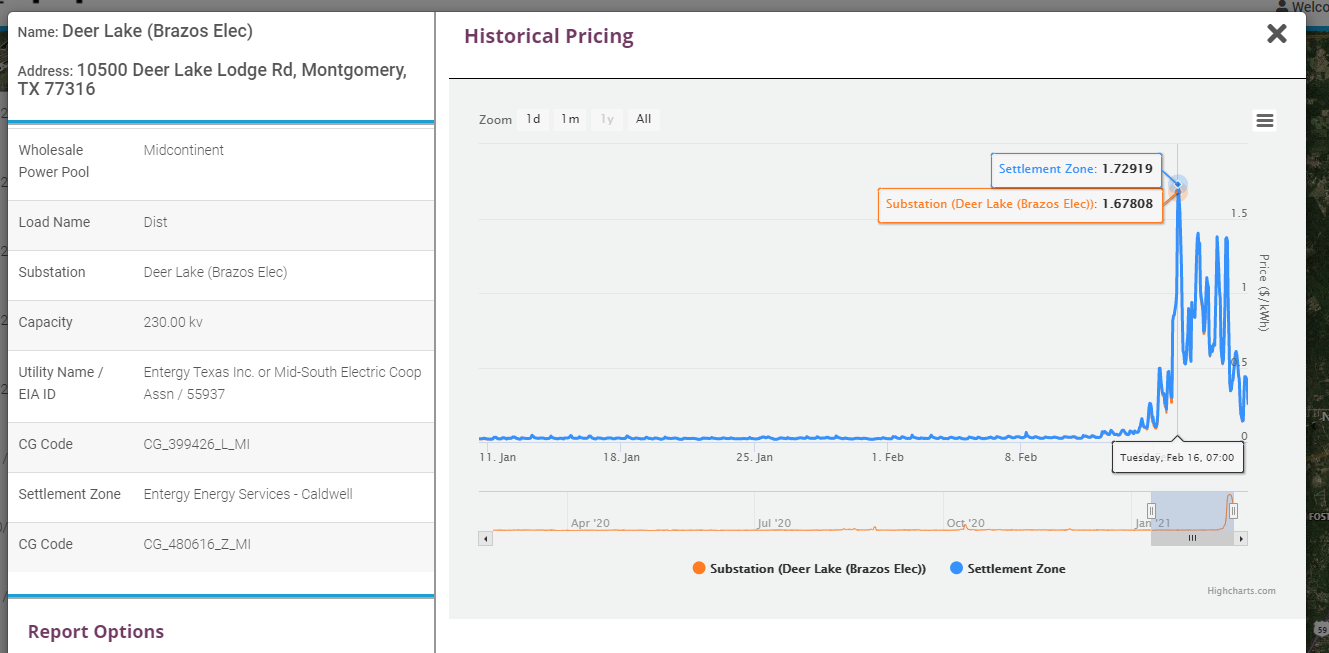

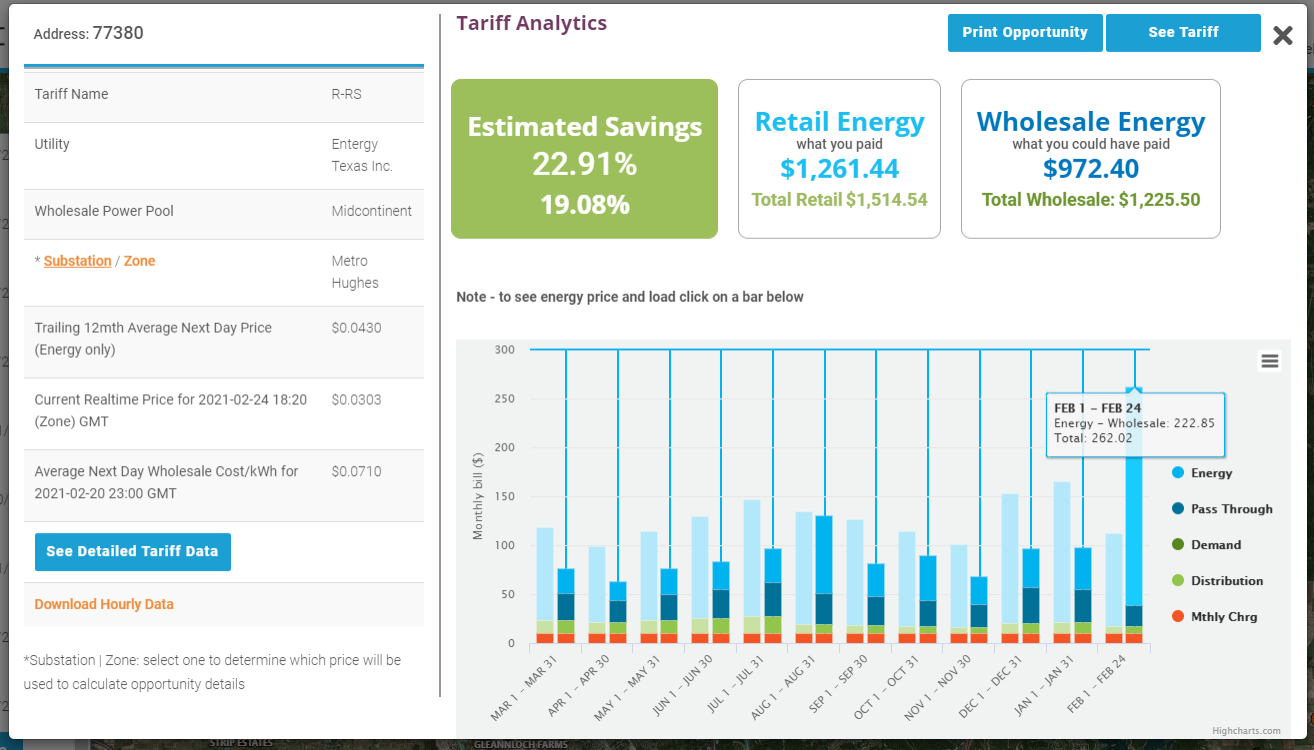

Montgomery, TX (Woodlands)

Given the outsize level of coverage of ERCOT’s issues during the price freeze, it is helpful to review the experience of customers in virtually the same geographic area but different market structure. Many Texas consumers are unaware (or were prior to this month!) that ERCOT only serves about 85% of the State. MISO and its Distribution Utility Entergy serve the Woodlands region just North of Houston. Most retail energy consumers in this area are on Entergy’s R-RS rate which averages only just over $.01 for Distribution. However, since this is a regulated rate the consumer has no alternative to also paying almost $.09 for Energy, bringing their all-in rate to just over $.10 per kwh. As mentioned, despite being a regulated market for consumers, wholesale power still trades in the MISO market in much the same way as in deregulated EROCT. Reviewing Chart 5 shows the price history for this market Entergy Energy Services-TX. While averaging slightly more prior to the freeze, $.025-.035 per kwh, price spikes were much more muted in the mid-February period, spiking at times to $1.50-$2.50 per kwh but mostly in the $.75 to $1.00 range evidencing some strains on the MISO grid. In keeping with the Wholesale to Retail comparison the average retail consumer in the Woodlands would have paid about $100 per month for electricity while buying at wholesale rates would have averaged about 30% less prior to February, Chart 6. Incurring the full effect of wholesale prices would have sent the average retail bill from about $70 to about $270 for the full month, a large jump but nowhere near ERCOT. It should be mentioned that MISO assesses larger non-energy costs, e.g., capacity, to its wholesale market participants which reduce potential wholesale savings even if possible, under the regulatory structure.

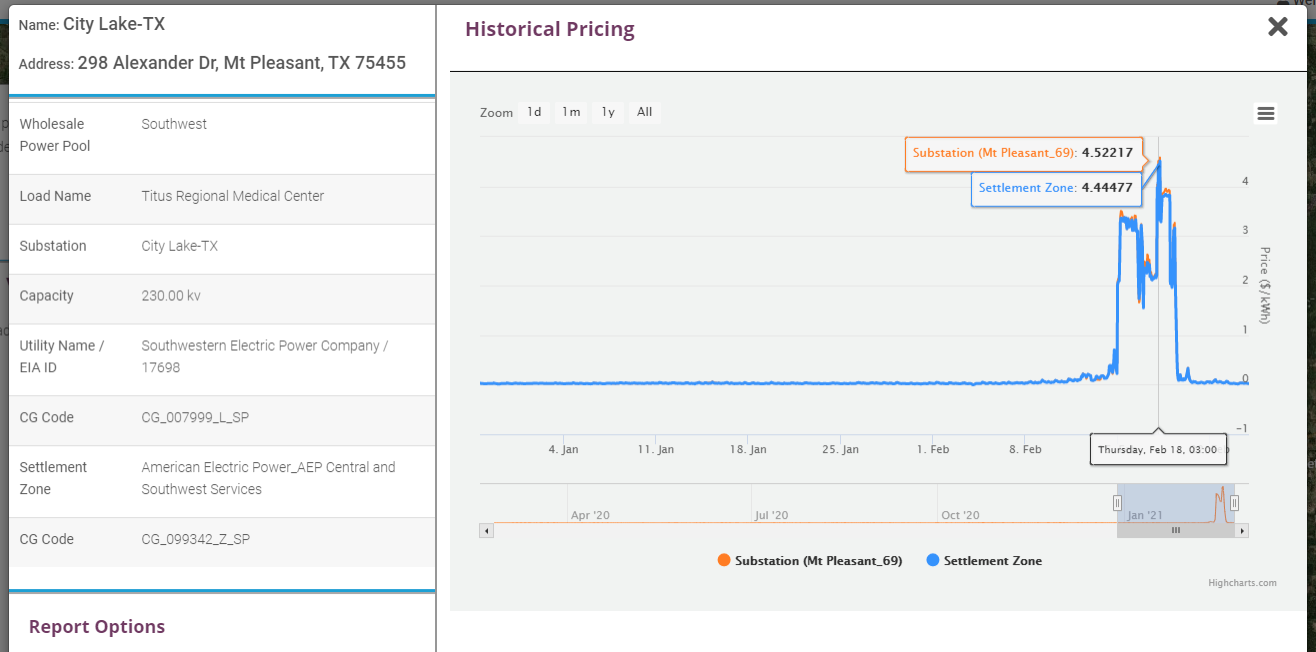

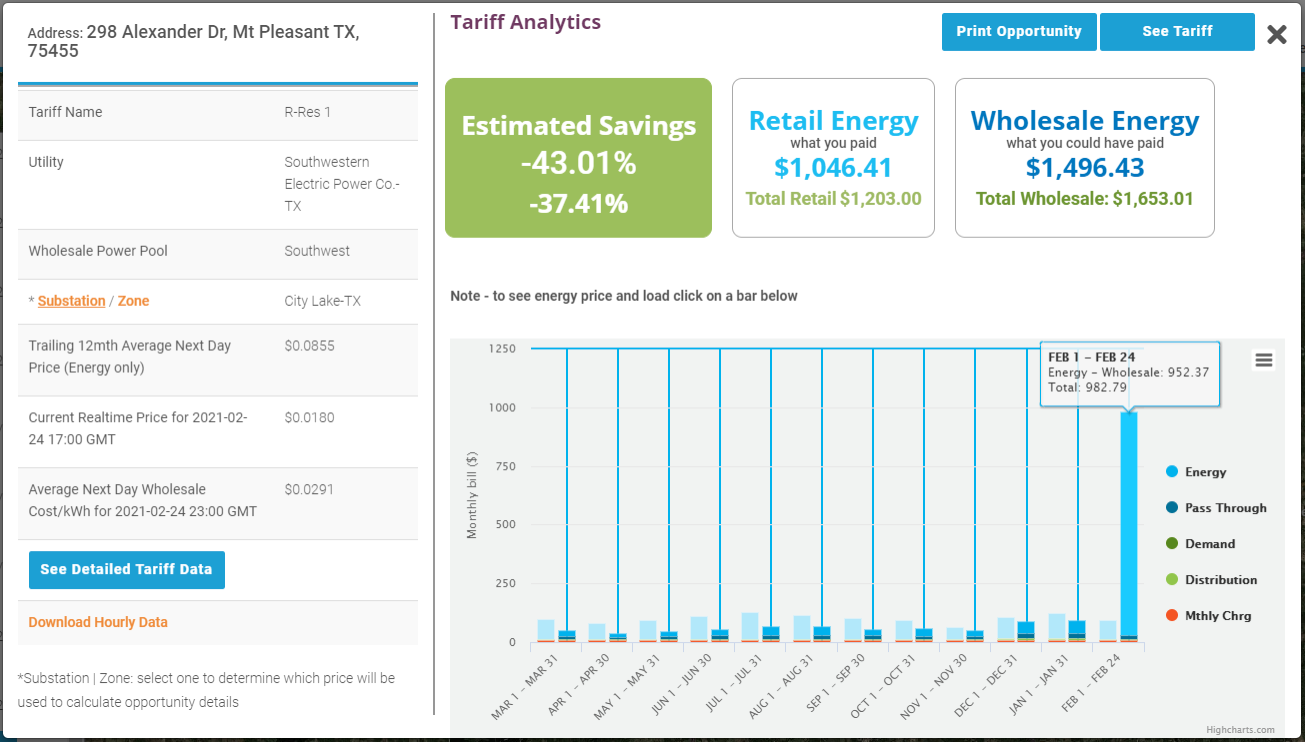

Mount Pleasant (Longview)

Lastly, a third ISO, Southwestern Power Pool, serves some areas of Texas including the Longview region of Southeastern Texas. Chart 7 shows the effect of the freeze on wholesale prices in the SPP region of AEP_Central. Unlike MISO wholesale prices gapped early Monday morning 2/15 to the $3.50 kwh range and hardly deviated from that until again Friday at 7:00 am 2/19 and peaking at $4.50 on Thursday 2:00 pm. Longview is served by Southwestern Electric Power and residential customers are served under its R-Res 1 Rate. Distribution costs are negligible under this rate averaging less than $10 per month for most consumers. Again, however retail customers have no other alternative but to pay the stated energy rates offered by the regulated Utility which begin at $.077 and reduce to just under $.05 after 600 kwhrs of monthly consumption. Under this regulated rate structure, the average retail consumer pays just over $90 per month, compared to just over $50 should they have the option to purchase at fully loaded wholesale rates. Of course, all these savings again would have vanished in February as the average residential bill would have shot up to just under $1,000, much higher than MISO (Woodlands), but much less than ERCOT (Dallas and Houston).

Summary

Clearly ERCOT severe reliability issues during the Freeze and market structure and led to wholesale prices which were unsustainable to all but the most sophisticated energy consumer. All gains realized from full pass through of wholesale savings were erased by several orders of magnitude. However, very high prices were seen in the regulated Texas regions operated by MISO and especially SPP which reveal real costs which must be borne and real issues of potential reliability for these regulated markets as well. Lastly, Suppliers (REPs and Utilities) will in the future need to factor both higher prices and higher volatility into their forward fixed prices which will ultimately be borne by consumers in both de-regulated as well as regulated markets.