As analyst probe usage statistics to determine the effects of the Coronavirus Pandemic on electricity demand, the longer-term trends of declining power bills for residential and commercial customers remain intact. We synthesized 12 months of bills for select cities in deregulated markets from September 2019 through April 2020 and In all samples prices ranged from almost flat in Champaign, IL (MISO), to over 20% lower in Hartford, CT (NEISO). Surprisingly, even with the super peak pricing experienced in ERCOT last August, annual prices declined by over 7% over the same period. This trend held true, although to a lesser degree when utility tariff costs for delivery were considered. Tariff rate inflation caused savings in NEISO and PJM to be more muted, while increases in delivery rates removed any savings and led to increases in total electric bills in ConEd, Centerpoint, and Oncor territories. These trends are likely to continue as utilities seek to recoup losses due to pandemic related non-payment as well as new costs for health and safety. By contrast, sharp declines in commodity prices as well as component costs for renewable generation can be expected to exert significant downward pressure on wholesale energy costs.

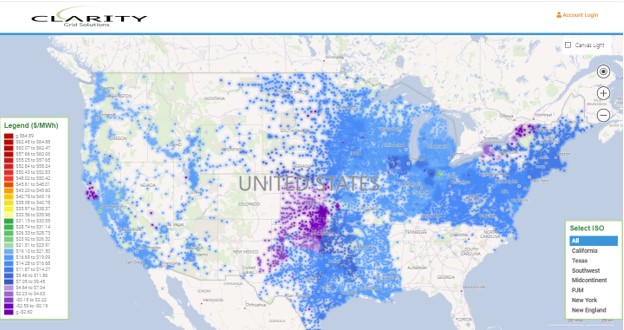

Unlike most snapshots of power market prices, Clarity Grid’s platform encompasses residential and commercial load profiles when reviewing price changes over time and tracks both the wholesale components such as capacity, Ancillary, ISO cost, as well as the delivery charges as reflected in the local tariffs, so usable insights can be made into the electricity market as a whole.